Intelligence infrastructure

for private markets

From initial outreach to investment memo, on autopilot

Automated fund due diligence

for limited partners

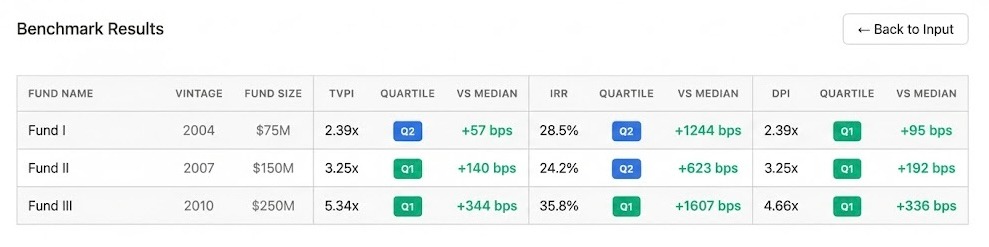

Performance benchmarking

Veylance benchmarks funds using PitchBook, Cambridge Associates, and Burgiss data—automatically selecting the right peer set by strategy, with full control to filter and customize benchmarks as needed.

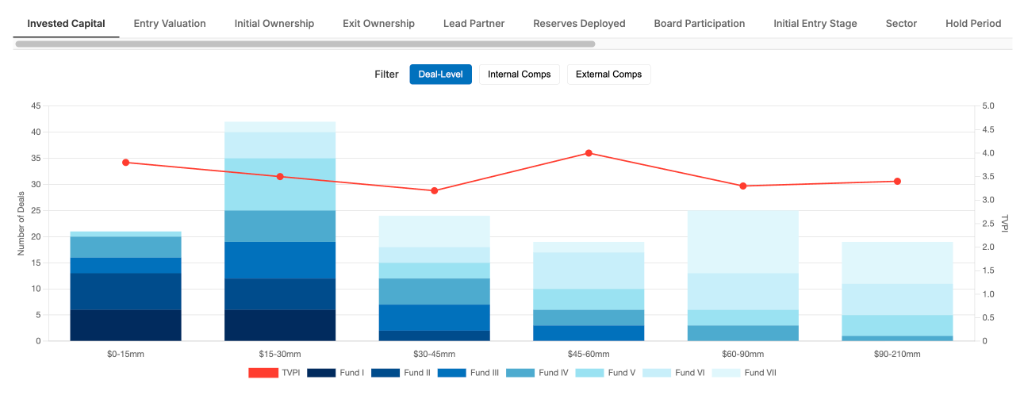

Deal-level performance attribution

Turn historical track records into deal-level insight that shows what worked, what didn’t, and how those patterns compare to internal and external precedents.

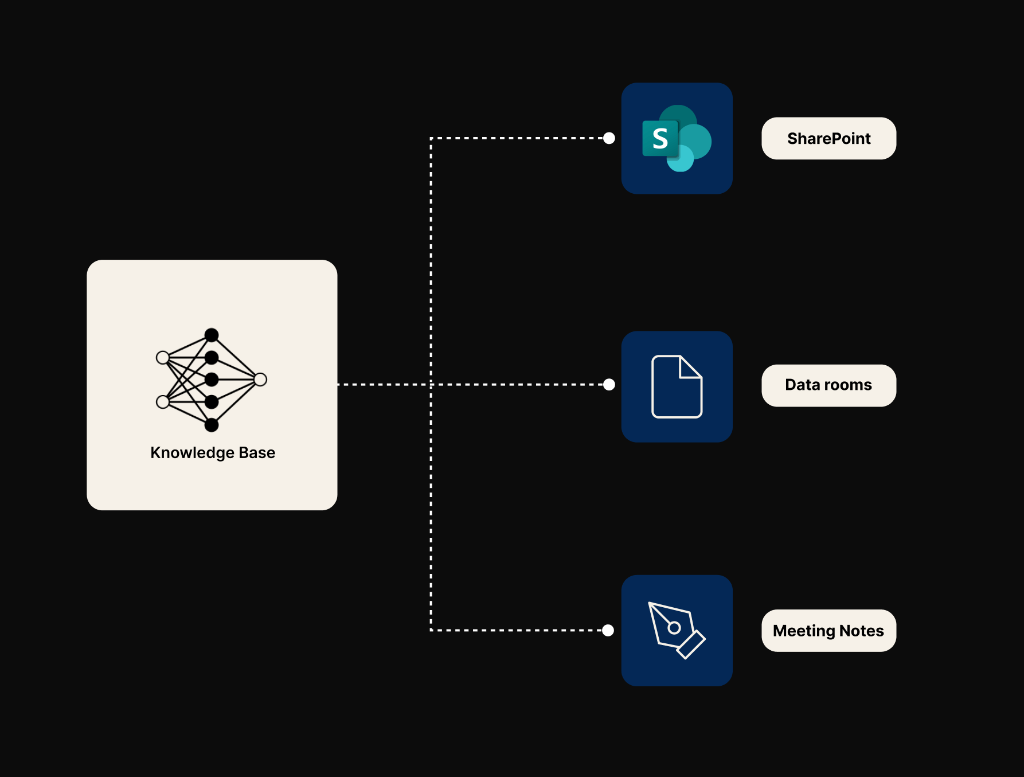

Full context for every investment decision

Veylance connects to your CRMs and internal systems, ingesting unstructured data across memos, emails, and data rooms, so every decision reflects your firm’s full knowledge base.